“She is too poor to be in the group,” said several women in a microcredit group as a woman in tattered clothing carries a huge load of straw past our meeting place. They had just said that they are the poorest women in the village.

Now, the group secretary explained that the woman cannot afford the stipulated monthly saving amount of Rs 50 because her few rupees all get spent before the meeting. Plus, she was too busy as a day labourer to attend the monthly meetings.

Now, the group secretary explained that the woman cannot afford the stipulated monthly saving amount of Rs 50 because her few rupees all get spent before the meeting. Plus, she was too busy as a day labourer to attend the monthly meetings.

This incident, several years ago, was a key to the thinking for CORE’s saving-&-credit project, “A Hand-Up”.

First, the stipulated saving amount excluded the poorest people, so we ensured that there were not any stipulated minimum saving amounts to hinder very poor people from participating in the group.

Secondly, the poorest people survive on day wages that are usually just enough for their basic needs of that day. With demands for food and shelter, they have a hard struggle, if at all possible, to keep enough rupees for a saving group.

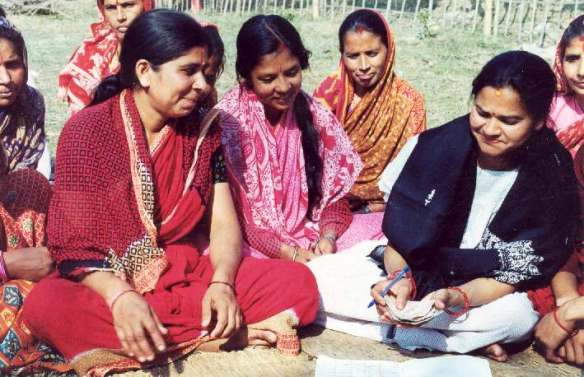

With our Nepali partner organisation, Society for the Urban Poor (SOUP), we have the facilitators visit the group members each day to collect their few rupees of daily saving whether 10, 30, or 100 rupees.

With our Nepali partner organisation, Society for the Urban Poor (SOUP), we have the facilitators visit the group members each day to collect their few rupees of daily saving whether 10, 30, or 100 rupees.

With the power of even just five rupees per day, most members have gradually increased the amount that they can save each day and built up a saving account that they had never dreamed possible.

Most members (mostly women but a few men) report that they feel a much greater sense of satisfaction and empowerment from saving than from taking loans. Several studies and much larger programs have verified this finding.[1] Each of them knows that their families survived on loan after loan in the villages. But, saving a hundred dollars’ worth of rupees is a real accomplishment to them.

The saving amount of each member then serves as collateral for small loans to meet emergency needs and for capital to purchase more stock or equipment to improve their small enterprises. The loans come from both the saving fund of the group and a revolving fund provided by CORE.

Our stipulation is that the loans are small so that they can be readily repaid and so that the funds are available to more of the members. Some women have taken up to seven rounds of loans, which they repay and then borrow a somewhat larger amount if they need it. Gradually, some of these members join a larger group or cooperative to have access to larger loans.

Most of the ‘graduating’ members stay members of the ‘Hand Up’ group for the sense of solidarity with the other members. But, their moving on for bigger loans is our greatest satisfaction.